On the other hand, the variable cost associated with the manufacturing of widgets has been calculated to be $0.70 per unit, which consists of raw material cost, labor expense, and sales commission Sales Commission Sales commission is a monetary reward awarded by companies to the sales reps who have managed to achieve their sales target. The fixed costs add up to $80,000, which consists of asset depreciation, executive salaries, lease, and property taxes. Let us assume a company ABC Ltd which is in the business of manufacturing of widgets.

#Break even point download

You can download this Break-Even Point Formula Excel Template here – Break-Even Point Formula Excel Template Example #1

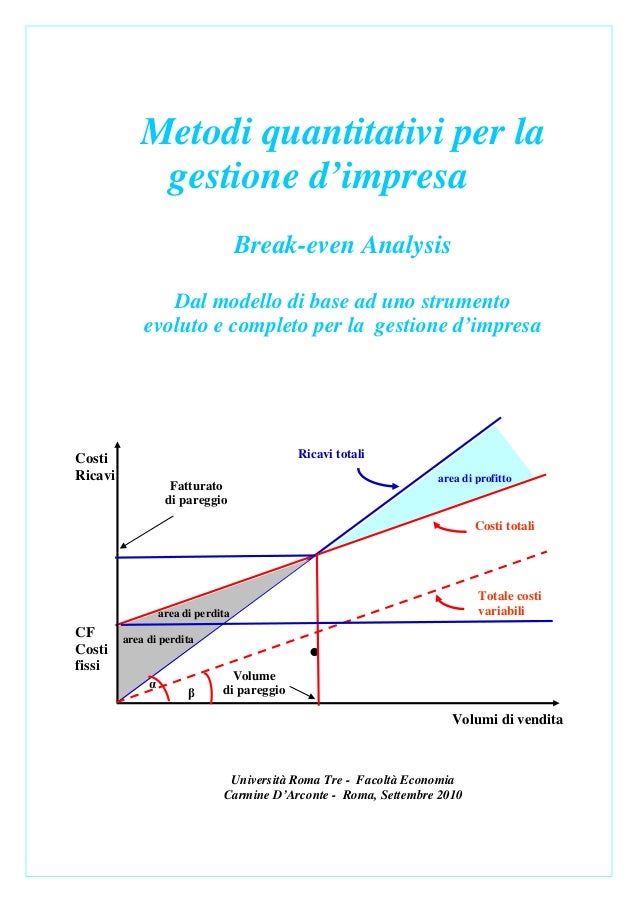

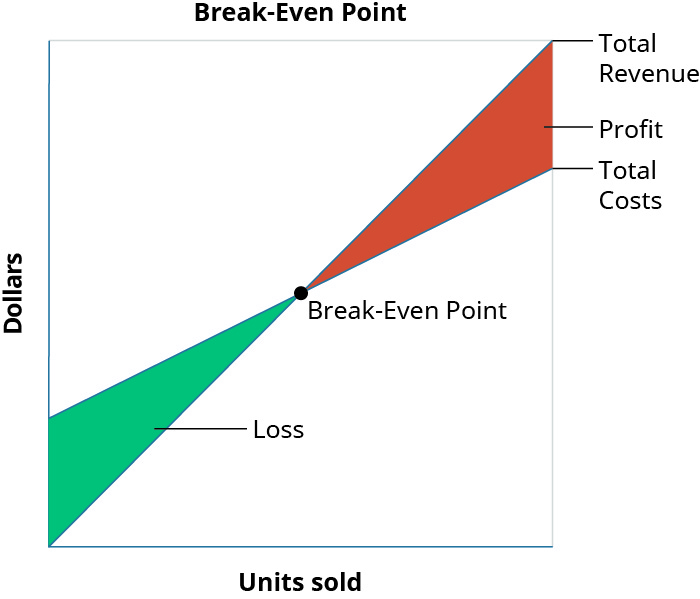

read more include (not exhaustive) interest expense, taxes paid, rent, fixed salaries, depreciation expense, labor cost, etc. It is the type of cost which is not dependent on the business activity. The fixed costs Fixed Costs Fixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. Fixed costs do not vary according to the production volume.

The variable costs primarily include raw material cost, fuel expense, packaging cost, and other costs that are directly proportional to the production volume. Variable costs will vary in direct relation to the production or sales volume.

read more and the quantity of production.

0 kommentar(er)

0 kommentar(er)